Episode 7: The Time Value of Money

Do you know you would need to invest approximately ₹8,34,058 today to have ₹20,00,000 in 15 years at an annual interest rate of 6%.

Welcome back to “The Wise Investor.” Throughout our previous discussions, we have laid a strong foundation by exploring the basics of investing, the critical importance of setting investment goals, and the formidable power of compound interest. Today, we turn our attention to a cornerstone principle in finance: the time value of money (TVM). Mastery of this concept is ential for making informed investment decisions and optimizing your financial

strategy.

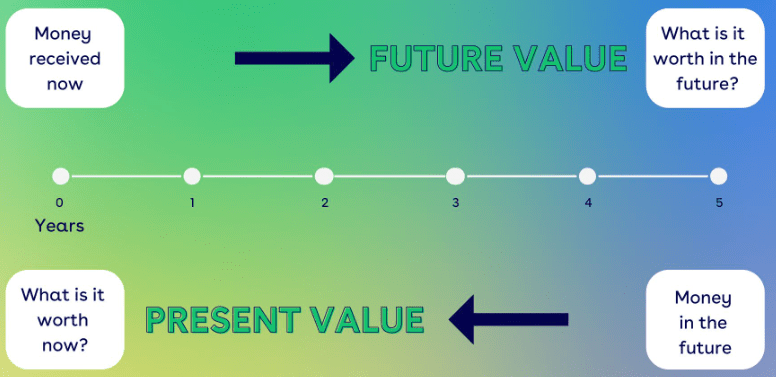

What is the Time Value of Money?

The time value of money (TVM) is the concept that money available today is worth more than the same amount in the future due to its potential earning capacity. This principle acknowledges that money can earn interest or be invested, thereby increasing its value over time.

Key Concepts of TVM

- Present Value (PV): The current worth of a sum of money or stream of cash flows given a specified rate of return. It represents the amount you would need to invest today to achieve a future amount.

- Future Value (FV): This represents the value of a current asset at a future date, based on an assumed rate of growth. It provides insight into how much an investment made today will grow over time.

- Discount Rate: The interest rate used to discount future cash flows to their present value, reflecting the time value of money.

- Annuities: These are series of equal payments made at regular intervals. Annuities can be classified as ordinary (payments at the end of each eriod) or due (payments at the beginning of each period).

The Importance of TVM in Investing

Understanding TVM helps investors make better financial decisions by evaluating the worth of future cash flows in today’s terms. This concept is crucial for:

- Investment Appraisal: Determining the present value of future returns to assess the viability of an investment.

- Loan Analysis: Calculating the present and future values of loan repayments.

- Retirement Planning: Estimating the future value of current savings to ensure adequate funds for retirement.

Calculating Present and Future Value

Present Value Formula

The present value formula is used to determine the current worth of a future sum of money or cash flow:

PV = FV/(1 + r)^n

Where:

- PV = Present Value

- FV = Future Value

- r = Interest rate (decimal)

- n = Number of periods

Future Value Formula

The future value formula calculates the value of an investment after a specified period:

FV = PV (1 + r)^n

Where:

- FV = Future Value

- PV = Present Value

- r = Interest rate (decimal)

- n = Number of periods

Practical Examples

Let’s consider a practical example to illustrate the time value of money. Example: Saving for a Child’s Education Imagine you want to save for your child’s education, which will cost ₹20,00,000 in 15 years. You want to know how much you need to invest today to reach this goal, assuming an annual interest rate of 6%.

Present Value Calculation

PV = ₹20,00,000/{(1 + 0.06)^15}

= PV = ₹20,00,000/{(1.06)^15}

= PV = ₹20,00,000/2.396

= PV = approx ₹8,34,058

You would need to invest approximately ₹8,34,058 today to have ₹20,00,000 in 15 years at an annual interest rate of 6%.

The Power of Early Investment

The time value of money underscores the importance of starting your investments early. The earlier you invest, the more time your money has to grow, benefiting from compound interest and maximizing your returns.

Example: Early vs. Late Investment

| Early Investor (Ankit) | Late Investor (Neha) | |

|---|---|---|

| Condition | Invests ₹1,00,000 at age 25 Interest rate: 8% per year Investment period: 40 years | Invests ₹1,00,000 at age 35 Interest rate: 8% per year Investment period: 30 years |

| FV Calculations | FV = ₹1,00,000 (1 + 0.08)^{40} =FV = ₹1,00,000 * (21.724) =FV approx. ₹21,72,400 | FV = ₹1,00,000 * (1 + 0.08)^{30} =FV = ₹1,00,000* (10.063) = FV approx. ₹10,06,300 |

Ankit’s investment grows to approximately ₹21,72,400, while Neha’s grows to approximately ₹10,06,300, demonstrating the significant impact of starting early.

Conclusion:

The time value of money is a foundational concept in finance that emphasizes the benefits of early and consistent investing. By understanding and applying TVM principles, you can make informed financial decisions, optimize your investment strategy, and achieve your financial goals more effectively.

In our next episode, we will explore “Inflation and Its Impact on Investments” Stay tuned as we continue to guide you through the exciting world of investment.

Remember, time is one of the most powerful tools in your investment arsenal. Let us continue this journey together and unlock the full potential of your financial future.

<<Previous Page_____________________________________Next Page>>

Leave a comment