Chapter 1: Bollinger bands- The Basics

Date: 10 Sept 2024

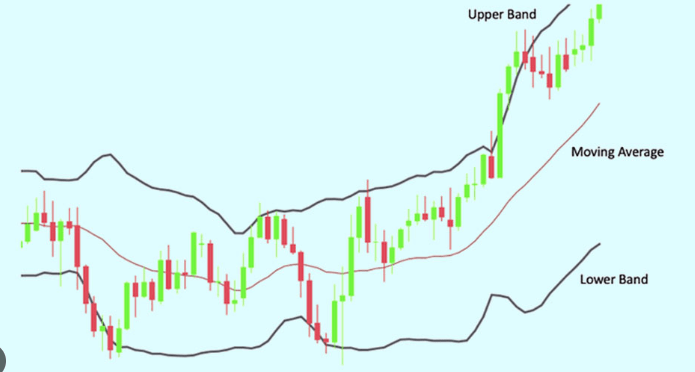

In the opening chapter, John Bollinger introduces the concept of Bollinger Bands, a technical analysis tool designed to measure market volatility and provide traders with an intuitive visual guide for price movements. Bollinger Bands consist of a middle band, which is a simple moving average (SMA), and two outer bands that represent standard deviations from the SMA. The

primary purpose of these bands is to capture most of the price action within them, reflecting how volatility expands and contracts. The chapter also touches upon the importance of understanding volatility as a dynamic aspect of market behavior, laying the groundwork for the rest of the book.

Analysis:

Bollinger emphasizes that volatility is not static but fluctuates with market sentiment, making it a critical factor in trading decisions. The construction of Bollinger Bands, using a moving average and standard deviations, creates a framework that adapts to these fluctuations. This adaptability is one of the key strengths of Bollinger Bands, allowing traders to apply them across different timeframes and asset classes. The chapter serves as a foundational introduction, ensuring that readers understand the core principles before moving on to more advanced applications.

Key Takeaways:

Ψ Volatility Measurement: Bollinger Bands are designed to adjust to changing market volatility, making them a flexible tool for traders.

Ψ Dynamic Boundaries: The bands expand and contract in response to price movements, offering a visual representation of market sentiment.

Ψ Universal Application: Bollinger Bands can be applied to any financial instrument, from stocks to commodities, making them a versatile tool in a trader’s toolkit.

Relevance in Today’s Scenario:

In today’s fast-paced markets, where volatility can change rapidly due to factors like algorithmic trading, economic data releases, or geopolitical events, Bollinger Bands remain a critical tool for traders. The ability of Bollinger Bands to adapt to different market conditions makes them highly

relevant, whether in traditional markets like equities or more volatile markets like cryptocurrencies. Understanding the basics of Bollinger Bands is essential for anyone looking to navigate these ever-changing environments successfully.

Leave a comment