Chapter 3: Bollinger Bands-The Squeeze

Date: 12 Sept 2024

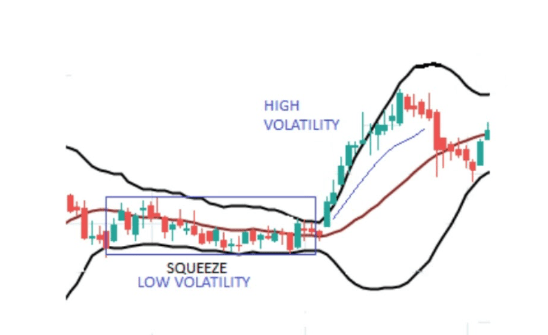

The Squeeze is one of the most powerful concepts introduced in this chapter. It occurs when the Band Width contracts to a historically low level, indicating reduced volatility and the potential for a significant breakout when volatility returns. Bollinger explains that the Squeeze is a precursor to explosive price movements, either up or down, and provides strategies for trading this setup.

Analysis:

The Squeeze is a critical signal for traders who specialize in breakout strategies. When Band Width narrows significantly, it reflects a period of consolidation where market participants are undecided. This lack of volatility is often followed by a sharp move as the market “breaks out”

from the consolidation phase. Bollinger advises traders to prepare for these moves by monitoring the Squeeze closely and using other indicators, like volume, to confirm the breakout direction. The Squeeze is particularly valuable because it offers a low-risk entry point, as traders can place stop-loss orders close to the consolidation range, minimizing potential losses.

Key Takeaways:

Ψ Low Volatility Indicator: The Squeeze identifies periods of low volatility, signaling that a significant price move may be imminent.

Ψ Breakout Potential: Traders can prepare for potential breakouts by monitoring the Squeeze and using it as an early warning signal.

Ψ Risk Management: The Squeeze offers a low-risk entry strategy, as the consolidation range provides a clear level for placing stop-loss orders.

Relevance in Today’s Scenario:

In today’s markets, where volatility can spike suddenly due to news events or algorithmic trading, the Squeeze remains a highly relevant concept. Traders who can identify and trade the Squeeze can capture significant profits from these breakout moves. The ability to anticipate volatility changes is crucial, especially in markets where rapid price movements are common, such as cryptocurrencies or during earnings season in equities.

Leave a comment