The Wise Investor

Episode 33: Introduction to Peer-to-Peer Lending

Date: 18 June 2025

Welcome back to “The Wise Investor.” In our previous episode, we explored the benefits of investing in Real Estate Investment Trusts (REITs). Today, we will delve into the innovative world of peer-to-peer lending (P2P lending). To make this topic more engaging, let’s start with a compelling story that highlights the potential and accessibility of P2P lending.

The Story of Rohan and His P2P Lending Experience

Rohan, a 34-year-old graphic designer, was looking for new ways to diversify his investment portfolio. He had already invested in stocks and real estate but wanted to explore alternative investments that could offer higher returns. One day, while attending a financial seminar, Rohan was introduced to the concept of peer-to-peer lending.

Intrigued by the idea of earning interest by lending money directly to individuals and small businesses, Rohan decided to research P2P lending platforms. He learned that P2P lending connects borrowers with investors through online platforms, bypassing traditional financial institutions. This model not only provided higher returns but also allowed Rohan to support entrepreneurs and individuals in need of loans.

Rohan started by investing a small amount in several P2P loans through a reputable platform. He appreciated the transparency and detailed information about each borrower, including their credit history, loan purpose, and risk profile. Over time, Rohan diversified his P2P lending portfolio across different loan categories and risk levels.

Rohan’s experience with P2P lending transformed his approach to investing. He enjoyed the steady interest income and the satisfaction of helping others achieve their financial goals. P2P lending became an integral part of his diversified investment strategy.

What is Peer-to-Peer Lending?

Peer-to-peer lending (P2P lending) is a method of lending money to individuals or businesses through online platforms that connect borrowers with investors. P2P lending eliminates the need for traditional financial intermediaries, such as banks, and allows investors to earn interest on their loans.

Key Characteristics of P2P Lending

- 1. Direct Lending: Investors lend money directly to borrowers through online platforms.

- 2. Higher Returns: P2P lending often offers higher returns compared to traditional savings accounts and bonds.

- 3. Diversification: Investors can diversify their P2P lending portfolio across multiple loans and risk levels.

- 4. Transparency: P2P lending platforms provide detailed information about borrowers, including credit history and risk profile.

Types of P2P Loans

1. Personal Loans

Personal loans are unsecured loans provided to individuals for various purposes, such as debt consolidation, home improvements, or medical expenses. Investors earn interest on the principal amount lent to borrowers.

2. Business Loans

Business loans are provided to small and medium-sized enterprises (SMEs) for business expansion, working capital, or equipment purchase. These loans may be secured or unsecured, depending on the borrower’s credit profile and business needs.

3. Student Loans

Student loans are provided to individuals to finance their education. These loans may offer lower interest rates and longer repayment terms to accommodate the financial needs of students.

Benefits of P2P Lending

1. Higher Returns

P2P lending often offers higher returns compared to traditional fixed-income investments, such as savings accounts and bonds. Investors can earn attractive interest rates by lending directly to borrowers.

2. Diversification

P2P lending allows investors to diversify their portfolios by investing in various types of loans across different risk levels and sectors. This diversification helps reduce risk and enhance potential returns.

3. Transparency and Control

P2P lending platforms provide detailed information about borrowers, including their credit history, loan purpose, and risk profile. This transparency allows investors to make informed decisions and control their investment strategy.

4. Social Impact

P2P lending enables investors to support individuals and small businesses in need of financing, creating a positive social impact. Investors can contribute to the growth of local economies and help borrowers achieve their financial goals.

Steps to Start Investing in P2P Lending

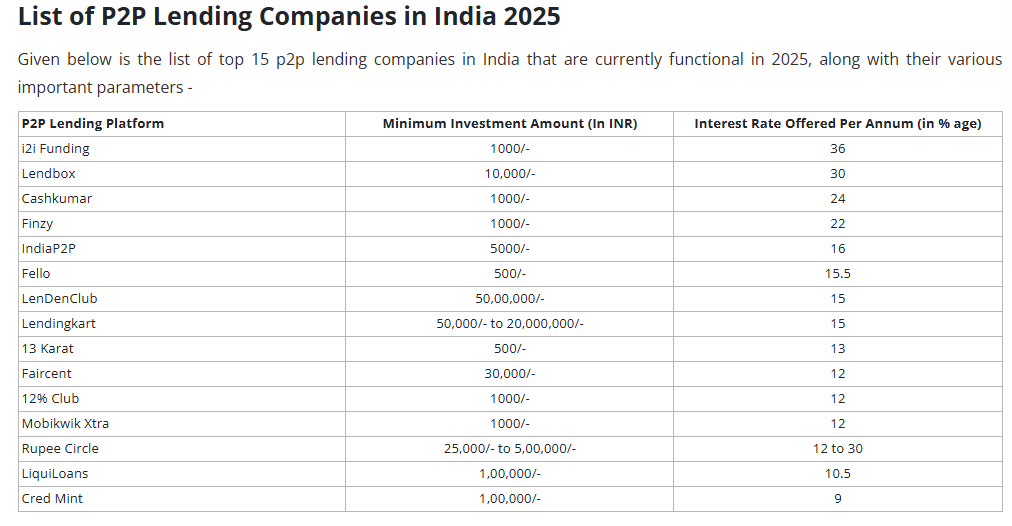

1. Research P2P Lending Platforms

Start by researching reputable P2P lending platforms. Look for platforms with a strong track record, transparent processes, and positive investor reviews.

Reference: https://www.investkraft.com/blog/list-of-p2p-lending-companies-india-2024

2. Understand the Investment Types

Familiarize yourself with the different types of P2P loans, including personal, business, and student loans. Understand the potential returns and risks associated with each type.

3. Conduct Due Diligence

Thoroughly research each loan before investing. Review the borrower’s credit history, loan purpose, and risk profile. Consider the interest rate, loan term, and repayment schedule.

4. Diversify Your Investments

Diversify your P2P lending portfolio across multiple loans and risk levels to reduce risk and enhance potential returns.

5. Monitor Your Investments

Regularly monitor your P2P lending investments and stay informed about the performance of each loan. Review updates from the lending platform and be prepared to make adjustments if necessary.

Conclusion

Peer-to-peer lending (P2P lending) offers a unique and accessible opportunity for individual investors to earn higher returns and diversify their investment portfolios. By understanding the different types of P2P loans, conducting thorough research, and diversifying your portfolio, you can take advantage of the benefits of direct lending and generate steady income. Avoiding the pitfalls of investing without proper diversification and due diligence, as seen in Ananya’s story, can lead to better investment outcomes and increased financial empowerment.

Disclaimer: The examples provided are for illustrative purposes only and do not constitute a recommendation to buy or sell any investments. P2P lending involves risks, and it is important to conduct thorough research or consult with a financial advisor before making any investment decisions.

In our next episode, we will explore Investing in Small Businesses. Stay tuned as we continue to guide you through the dynamic world of investment.

Remember, informed investing is the key to financial success. Let’s continue this journey together and unlock the full potential of your financial future.

Leave a comment