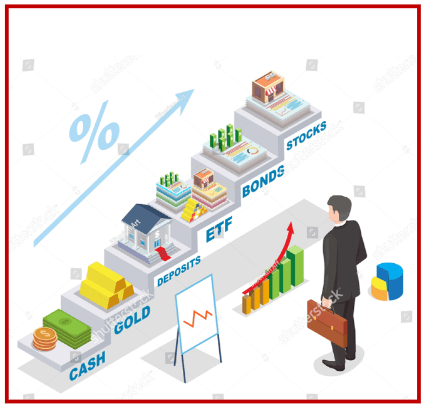

Episode 4: Types of Investment Vehicles

Welcome back to “The Wise Investor.” In our previous episodes, we discussed the fundamentals of investing, why investing is essential, and the critical relationship between risk and return. Today, we dive into the diverse world of investment vehicles. Understanding the various types of investment options available will help you make informed decisions and build a well-rounded portfolio tailored to your financial goals and risk tolerance.

What Are Investment Vehicles?

Investment vehicles are financial instruments that allow individuals and institutions to invest their money in various asset classes, each with its own risk and return characteristics. These vehicles provide the means to grow wealth, generate income, and achieve financial goals. Let’s explore the main types of investment vehicles.

Stocks – Equities

Stocks, or equities, represent ownership in a company. When you buy a share of a company, you become a part-owner and have a claim on a portion of its assets and earnings. Stocks are known for their potential for high returns, but they also come with higher risk due to market volatility.

| Pros | Cons |

| High potential returns | Higher risk and volatility |

| Ownership in a company | Potential for capital loss |

| Dividend income (for dividend-paying stocks) | Requires ongoing research and monitoring |

Bonds – Fixed-Income Securities

Bonds are debt instruments issued by corporations, municipalities, or governments. When you purchase a bond, you are lending money to the issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds are generally considered safer than stocks but offer lower returns.

| Pros | Cons |

| Regular interest income | Lower potential returns |

| Lower risk compared to stocks | Interest rate risk |

| Capital preservation (if held to maturity) | Inflation risk |

Mutual Funds – Pooled Investments

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional fund managers, mutual funds provide diversification and professional management, making them an attractive option for individual investors.

| Pros | Cons |

| Diversification | Management fees |

| Professional management | Potential for lower returns compared to individual stocks |

| Accessible to individual investors | Lack of control over individual investments |

Exchange-Traded Funds (ETFs) – Hybrid Investment Funds

ETFs are similar to mutual funds in that they offer a diversified portfolio of assets. However, ETFs trade on stock exchanges like individual stocks. This liquidity and flexibility make ETFs a popular choice for investors.

| Pros | Cons |

| Diversification | Market risk |

| Liquidity (can be bought and sold like stocks) | Trading costs |

| Lower fees compared to mutual funds | Can be less diversified than mutual funds |

Real Estate – Physical and Indirect Ownership

Investing in real estate involves purchasing physical properties (residential, commercial, or industrial) or investing in real estate investment trusts (REITs), which own and manage properties on behalf of investors. Real estate can provide steady income and potential appreciation.

| Pros | Cons |

| Steady rental income | High initial investment |

| Potential for property value appreciation | Property management responsibilities |

| Tangible asset | Market and liquidity risk |

Commodities- Tangible Assets

Commodities include physical assets like gold, silver, oil, and agricultural products. Investing in commodities can hedge against inflation and diversify a portfolio. Investors can buy physical commodities, commodity futures, or invest in commodity-focused ETFs.

| Pros | Cons |

| Inflation hedge | High volatility |

| Diversification | Storage and insurance costs (for physical commodities) |

| Tangible asset | Complex market dynamics |

Cryptocurrencies – Digital Assets (No Recommendation)

Cryptocurrencies like Bitcoin, Ethereum, and others represent a new and highly volatile asset class. These digital currencies operate on blockchain technology and have gained popularity for their potential high returns and revolutionary technology.

| Pros | Cons |

| High potential returns | Extreme volatility |

| Decentralized and secure | Regulatory uncertainty |

| Innovative technology | Limited acceptance and use |

Choosing the Right Investment Vehicles

Selecting the right investment vehicles depends on your financial goals, risk tolerance, and investment horizon. Here are some steps to help you make informed choices:

Define Your Financial Goals

Determine what you want to achieve with your investments. Are you saving for retirement, a down payment on a house, or a child’s education? Your goals will influence your choice of investment vehicles.

Assess Your Risk Tolerance

Understand your ability and willingness to endure market fluctuations. Your risk tolerance will guide your investment strategy and the types of vehicles you choose.

Diversify Your Portfolio

Diversification helps manage risk by spreading investments across different asset classes. A well-diversified portfolio can improve your chances of achieving stable returns.

Research and Stay Informed

Stay informed about the performance and risks associated with different investment vehicles. Continuous learning and market awareness are key to successful investing.

Conclusion

Understanding the various types of investment vehicles is essential for building a robust and diversified portfolio. Each vehicle offers unique advantages and risks, making it important to align your choices with your financial goals and risk tolerance.

In our next episode, we will delve into the strategies for building and managing a diversified investment portfolio. Stay tuned as we continue to guide you through the exciting world of investment.

Remember, the journey to financial growth is continuous, and every step you take today sets the foundation for a prosperous tomorrow. Let’s continue this journey together and unlock the full potential of your financial future.

<<Previous Page__________________________________Next Page>>

Leave a comment