Managing Household Expenses:

A Path to Financial Discipline and Growth In today’s fast-paced world, managing household expenses efficiently is crucial for financial stability and growth. One of the most effective methods is to allocate a fixed percentage of your income to various essential categories. This disciplined approach ensures that you cover your needs, invest in personal growth, enjoy life’s luxuries, save for the future, and give back to society. Here’s a guide to help you structure your budget and the advantages of adhering to this method.

Introduction

Achieving financial stability is a goal many strive for, but few manage to achieve. The key lies in disciplined budgeting and continuous monitoring of expenses. By allocating 60% of your income to household expenses, 10% to personal growth, 10% to luxuries, 10% to savings, and 10% to donations, you can create a balanced financial plan that caters to all aspects of your life. This method not only helps you manage your current financial obligations but also paves the way for future growth and fulfillment.

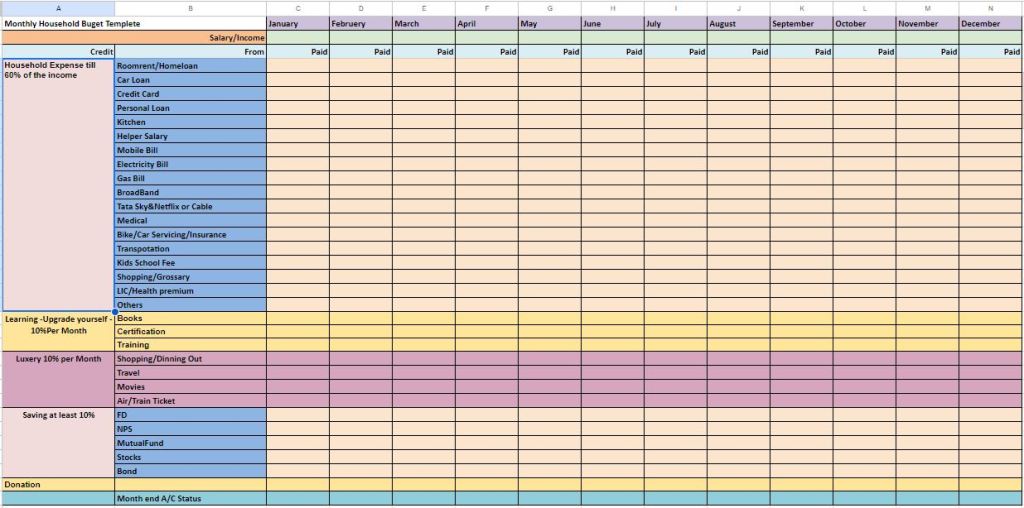

Click on below link or image to get the google sheet for Monthly Budget templete. It will help you to setup your monthly budget. You can download it or copy as google_sheet. Please do not update this google sheet.

Click here to get the Monthly Budget templete

The 60-10-10-10-10 Budget Plan

- Household Expenses – 60%: This includes all the essential costs such as rent or mortgage, utilities, groceries, transportation, and other daily necessities. Allocating 60% of your income to these expenses ensures that your basic needs are met without financial strain.

- Personal Growth – 10%: Investing in yourself is crucial. Whether it’s enrolling in a course, buying books, or attending workshops, allocating 10% of your income to personal growth ensures continuous learning and skill development, which can lead to better career opportunities and personal satisfaction.

- Luxuries – 10%: Life is not just about working and saving; it’s also about enjoying the fruits of your labor. Setting aside 10% of your income for luxuries allows you to indulge in occasional treats and experiences without feeling guilty or financially stressed.

- Savings – 10%: Building a financial cushion is essential for future security. Allocating at least 10% of your income to savings helps in creating an emergency fund, planning for retirement, or investing in future opportunities. It’s a critical step towards financial independence.

- Donations – 10%: Giving back to society is an enriching experience. By donating 10% of your income to charities or causes you believe in, you contribute to the well-being of others and foster a sense of community and compassion.

Advantages of the 60-10-10-10-10 Budget Plan

- Financial Stability: This budgeting method ensures that you cover all essential expenses while still having room for personal growth, enjoyment, savings, and charitable contributions. It creates a balanced financial life, reducing stress and increasing financial security.

- Personal Growth and Satisfaction: Investing in your education and personal development leads to continuous improvement, better job prospects, and personal fulfilment. It keeps you motivated and engaged in your personal and professional life.

- Balanced Lifestyle: By allocating funds for luxuries and donations, you maintain a balanced lifestyle. You can enjoy life’s pleasures and contribute to society, which enhances overall well-being and happiness.

- Future Security: Regular savings build a financial cushion that prepares you for unexpected expenses and future opportunities. It’s a proactive approach to securing your financial future.

- Philanthropic Impact: Consistent donations create a positive impact on society and also make you feel happy and satisfied with this activity. It fosters a culture of giving and helps in building a compassionate community.

Emergency Fund

In the event of a sudden money requirement for medical purposes or other emergencies, the 60-10-10-10-10 plan proves to be exceptionally beneficial. The 10% allocated to savings serves as an emergency fund, providing a financial buffer that can be crucial in times of need. This fund can help cover unexpected expenses without disrupting your overall budget or causing undue financial stress. By consistently saving, you ensure that you are prepared for unforeseen circumstances, adding an extra layer of security and peace of mind.

Tailoring the Plan for Different Income Groups

Different income levels require tailored budgeting plans to ensure financial health.

For low-income groups, prioritizing essential expenses is critical, so allocating 70% to household expenses, 5% to personal growth, 5% to luxuries, 15% to savings, and 5% to donations may be more appropriate.

Middle-income groups can stick to the original 60-10-10-10-10 plan, balancing essential needs with savings and personal growth. so allocating 65% to household expenses, 10% to personal growth, 5% to luxuries, 15% to savings, and 5% to donations may be more appropriate.

High-income earners, who have more disposable income, can consider allocating 30% to household expenses, 10% to personal growth, 10% to luxuries, 40% to savings, and 10% to donations.

This adjustment allows each income group to manage their finances effectively, ensuring a healthy financial lifestyle tailored to their needs and capabilities.

Conclusion

Adopting the 60-10-10-10-10 budget plan requires discipline and regular monitoring, but the benefits are substantial. By covering all essential areas of life—household expenses, personal growth, luxuries, savings, and donations—you create a well-rounded and secure financial plan. This method not only brings financial stability but also enhances personal growth, satisfaction, and community impact. Start today, and take control of your financial future with this balanced and disciplined approach.

Leave a comment